POWERED BY AI & AUTOMATION

Accelerate Payments & Reduce Denials In One Platform

Get faster claim reimbursements, avoid underpayments, decrease cost-to-collect, and reduce denials with our cloud-based, revenue-boosting A/R Recovery & Denial Management platform.

With intelligent claims prioritization, automated follow-ups, and rich analytics dashboards powering our platform’s A/R Optimizer and Revenue Insights modules, clients realize 2 to 5% net patient revenue uplift and 20% net new collections from their A/R and denied claims.

Clients also benefit from more accurate revenue modeling to improve their operations and bottom-line margins by preventing unnecessary lost revenue before claims become write-offs.

A/R OPTIMIZER MODULE

Boost Reimbursement Recovery

Armed with multiple real-time data points, including clinical data, our prediction algorithms are able to accurately predict the recoverability of outstanding claims.

Daily work orders are assigned to team members by prioritization algorithms so they can focus on working claims with the highest probability of reimbursement in the shortest amount of time rather than the typical focus on high dollar claims and claims close to timely filing limits.

Automated status checks help prevent claims from going unworked and aging out, leaving A/R teams free to focus on high-value work and touch more claims.

Analyze

claims inventory for actionable insights

Predict

recovery at claim and charge level

Prioritize

claim work queues for maximum recovery

Recover

payments with bots and intelligent workforce management

Optimize

with actionable insights from data pulled from recovery operations

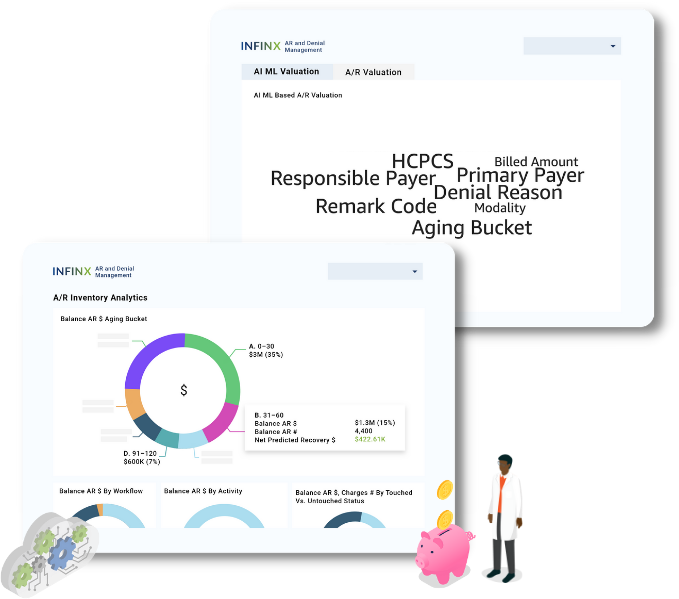

REVENUE INSIGHTS MODULE

Real-Time Data Helps Providers Pinpoint RCM Issues

With our Revenue Insights module, executives can assess their organization’s financial performance in minutes. Instead of manipulating data in spreadsheets for hours, they can view revenue cycle performance on demand in a single interactive dashboard and make proactive decisions with timely analytics.

Our advanced analytics technology centralizes revenue cycle data from multiple siloed systems and performs multi-modal examinations to identify reimbursement bottlenecks and revenue opportunities.

With the right insights delivered on time, executives can base their decisions on data and facts rather than guesswork. They can visualize the contribution of underlying factors like those listed below impacting revenue cycle KPIs and respond with corrective action:

- Assess recoverability by payers, procedures, facilities, denials, and aging buckets;

- Which payers and procedures are not getting reimbursed and why;

- Assess reimbursement shortfalls and by how much;

- Locate denial hotspots, anomalies, and rejection patterns; and

- Detect denial patterns before they further adversely impact financial performance.

STEP 1

AI Analyzes Claims Inventory For Insights

Complete RCM KPIs

Integrates clinical and revenue cycle data across multiple EHR and billing systems to provide a comprehensive oversight of current A/R inventory.

A/R inventory & denials insights

Enables visibility into the various A/R categories and supports deep analysis across multiple dimensions like facility, payer, denial and aging categories.

STEP 2

AI Predicts Claim Recovery

Charge recoverability

Continuous AI-powered predictive analysis of all outstanding A/R and denial inventory to determine recoverability at a claim or charge level.

Robust prediction model

Our prediction models operate at a high degree of accuracy and take into account claim status, payer guidelines, procedures, contractual allowed, denial complexity, remittances made, and more to determine recoverability.

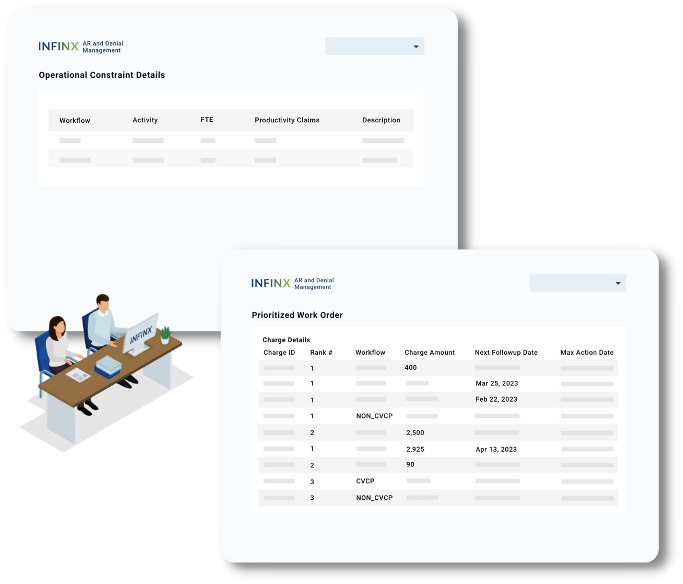

STEP 3

Claim Work Queue Prioritized For Maximum Recovery

Manage claim work queues

The prioritization algorithm automatically ranks and assigns a prioritized list of claims for A/R and denials specialists to resolve.

Operational constraints considered

Algorithms factor in not just the predicted dollars and timely filing limits, but also additional operational constraints including recently worked accounts, team skills, agent availability, productivity throughputs, and more in prioritizing work queues.

STEP 4

Recover Payments With Automation Agents And Intelligent Workforce Management

Integrated workforce + automation

Automation capabilities integrated into workforce management perform automated claim status checks across payer and clearinghouse portals to cut down time spent by A/R specialists per claim.

Intelligent payer mapping

The system simplifies and speeds up the process by identifying which automation agent to run. Based on the claim information, it identifies the correct clearing house, benefits manager, or payer portal to visit using advanced data mapping techniques.

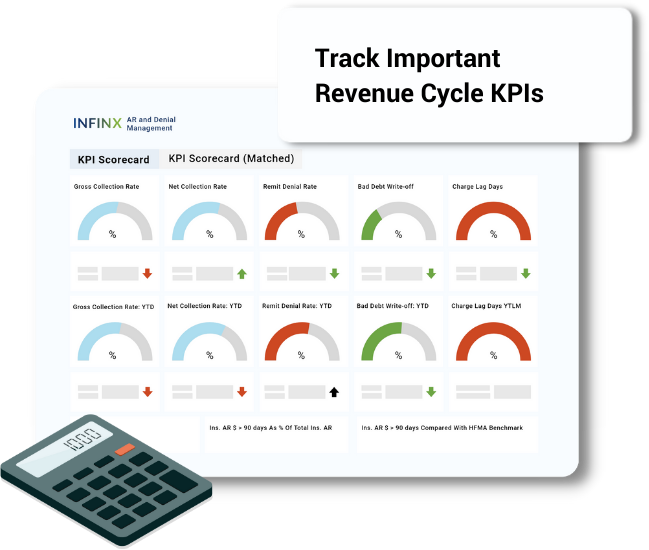

HELPFUL DASHBOARDS

Drive Performance Improvements With RCM KPIs

Here are some dashboards our clients find useful in reviewing when determining where correction revenue cycle optimization action can take place.

A/R Inventory Analytics

Provides single source, comprehensive visibility into current A/R and denial inventory status.

Payment Trends

Track payments, refunds, and net payments, by patients and insurance over time. Zoom in on facilities, procedures, payers and more.

Gross Collection Rate (GCR) Trends

See trends in collections over time, stratified by payer, facility, procedure and more.

Shortfall Data

Identify sources of shortfalls by CPT code, modality, shortfall amounts, and more.

METRICS THAT MATTER

Revenue Cycle Metrics We Track

Our solution measures itself against against the following KPIs to continuously optimize our clients’ revenue recovery performance:

- Increase monthly collection $ to accelerate cashflow

- Increase Gross Collection Rate (GCR)

- Increase Net Collection Rate (NCR)

- Decrease Days in A/R

- Decrease A/R over 90 Days

- Provides insights for denial prevention and reduce denial rate

- Meet 95% QA audit performance

- Exceed A/R specialist productivity targets

FINANCIAL BENEFITS

Positive Results After Implementation

2–5%

net patient revenue improvement

20%

higher A/R and denials recovery

15%

cost-to-collect reduction

30%

aging A/R reduction

15-20%

increase in collections

Integrations

Compatible With Most EMRs

We offer bi-directional integration with most EHR/EMR/LIS/RIS with API, HL7, FHIR, X12 or EMR developer programs so that your staff can submit and update financial verification requests from your local system Here are some of the systems we integrate or are compatible with.

EDUCATION

Helpful Resources For Your Team

We create educational materials frequently in the form of virtual office hours, articles, white papers, webinars and podcast episodes which help our clients and peers with common patient access and revenue cycle challenges they face. If you would like us to address a specific topic, feel free to reach out to us.

Reviews

Our Clients Grow With Us

As we streamline their organization’s patient access workflows, clients are happy with increased results, as well as improved cash flow due to increase in reimbursements and reduction of claim denials due to eligibility. They usually end up retaining us for other revenue cycle management tasks.

“Post pandemic onset, I had to rush to my drawing boards to revaluate risks, discover revenue opportunities, and find avenues to cut costs. With Revenue Insights, I get my answers out of the box. It has helped in benchmarking performance, identifying revenue risks ahead of time and bringing predictability to our financial outcomes.”

Chief Financial Officer

National Physician Group

“When you are managing A/R at an organization of our size, you really have to be at your best and strategize daily. A/R Recovery and Denials Management (ARDM) has made life easy and efficient for my operational managers where they do not have to figure out where to invest efforts and what to allocate. The AI/ML-based recovery prediction is a game-changer and provides a continuous collection potential of A/R inventory. My team’s reaction time to resolve issues and work on new revenue opportunities has improved tremendously. With ARDM, we are seeing additional dollars flowing in, our net collection rates have improved, we do not have to write-off as much and our inventory aging is in a spectacular spot.”

Senior Vice President of Revenue Cycle Operations

National Radiology Group

“Before A/R Recovery and Denials Management (ARDM), I used to daily struggle crunching and analyzing the A/R inventory, filtering accounts, applying various strategies, resource planning, and manually allocate work to agents on the ground. But now, ARDM does all of that for me, and even applies multiple other dimensions to the prioritization strategy that I could always dream of applying manually. My time is now freed from data crunching and operational reporting. I am now able to focus on things where I am best at – spending time with my team to act on issues, and improve our RCM operations and reimbursements.”

Revenue Cycle Operations Manager

Large Imaging Center Group